8 Simple Techniques For The Wallace Insurance Agency

Table of Contents4 Simple Techniques For The Wallace Insurance AgencyThe Only Guide for The Wallace Insurance AgencySome Known Details About The Wallace Insurance Agency Unknown Facts About The Wallace Insurance AgencyThe Main Principles Of The Wallace Insurance Agency The Wallace Insurance Agency Things To Know Before You BuySome Ideas on The Wallace Insurance Agency You Should KnowThe The Wallace Insurance Agency Statements

These plans likewise offer some security component, to assist make certain that your beneficiary obtains economic compensation must the unfavorable take place throughout the tenure of the policy. The simplest way is to start believing concerning your priorities and needs in life. The majority of individuals begin off with one of these:: Against a history of increasing clinical and hospitalisation prices, you might desire broader, and higher coverage for medical expenses.Ankle sprains, back strains, or if you're knocked down by a rogue e-scooter cyclist., or normally up to age 99.

Facts About The Wallace Insurance Agency Uncovered

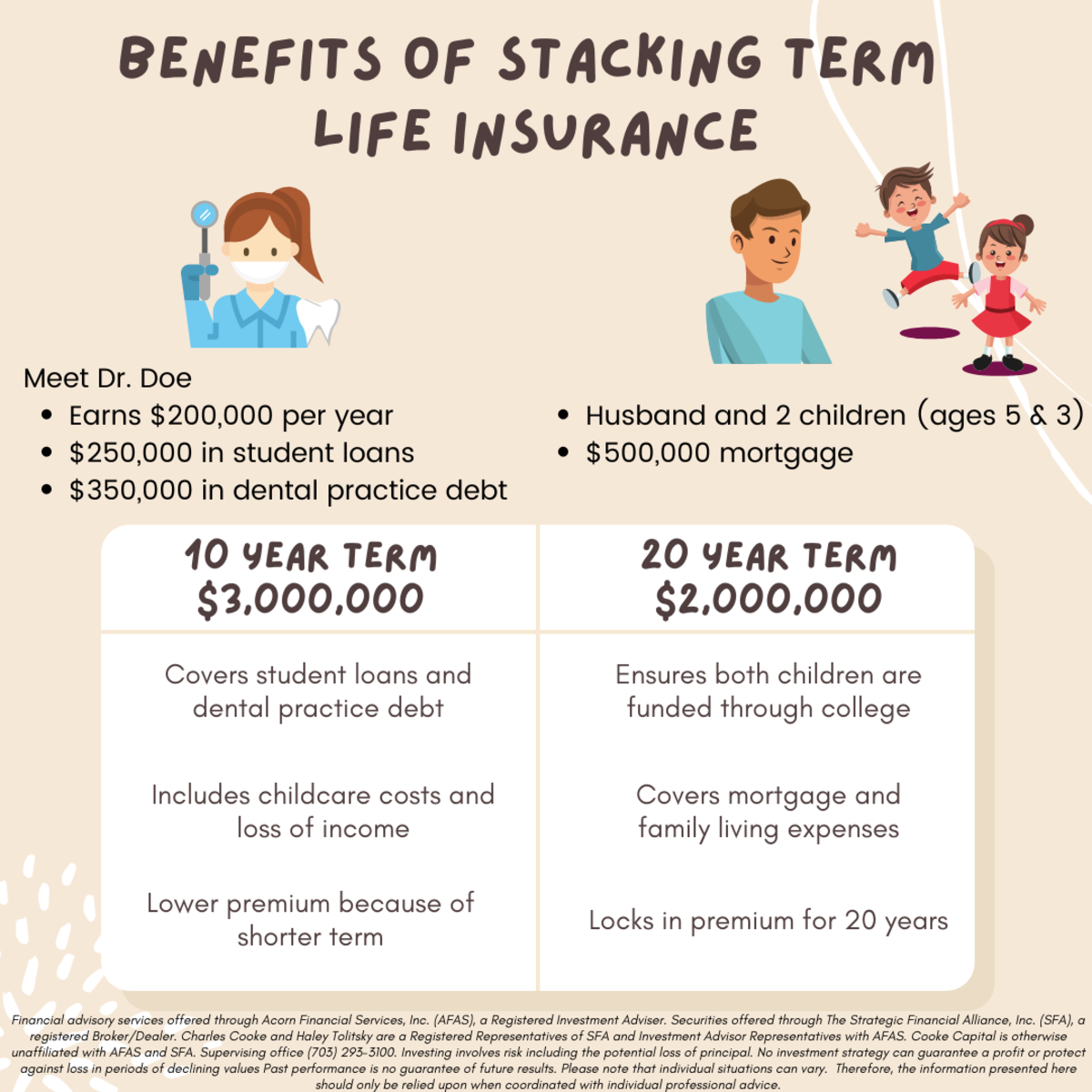

Depending upon your coverage strategy, you get a round figure pay-out if you are completely disabled or seriously ill, or your enjoyed ones get it if you pass away.: Term insurance policy provides coverage for a pre-set amount of time, e - Affordable insurance. g. 10, 15, twenty years. Due to the fact that of the shorter coverage duration and the lack of money worth, premiums are generally lower than life plans

, and gives yearly money benefits on top of a lump-sum quantity when it grows. It commonly consists of insurance policy protection against Complete and Irreversible Special needs, and fatality.

Some Known Incorrect Statements About The Wallace Insurance Agency

You can pick to time the payment at the age when your child mosts likely to university.: This gives you with a regular monthly income when you retire, typically in addition to insurance coverage.: This is a means of conserving for temporary objectives or to make your money job harder versus the pressures of rising cost of living.

The smart Trick of The Wallace Insurance Agency That Nobody is Talking About

While obtaining various plans will give you much more extensive insurance coverage, being excessively shielded isn't an advantage either. To prevent undesirable financial stress and anxiety, compare the policies that you have versus this checklist (Insurance claim). And if you're still uncertain concerning what you'll require, exactly how much, or the kind of insurance coverage to get, seek advice from a monetary expert

Insurance coverage is a long-lasting commitment. Constantly be sensible when deciding on a strategy, as switching or terminating a strategy prematurely typically does not generate monetary advantages.

What Does The Wallace Insurance Agency Mean?

The very best part is, it's fuss-free learn the facts here now we automatically exercise your money moves and provide money suggestions. This article is implied for info just and needs to not be counted upon as financial advice. Before making any type of choice to buy, offer or hold any kind of investment or insurance policy product, you should consult from a monetary advisor concerning its viability.

Spend just if you understand and can monitor your financial investment. Expand your investments and stay clear of spending a big portion of your money in a solitary item provider.

The smart Trick of The Wallace Insurance Agency That Nobody is Discussing

Just like home and auto insurance coverage, life insurance policy is crucial to you and your household's economic protection. To help, let's check out life insurance policy in much more information, exactly how it works, what worth it might give to you, and how Financial institution Midwest can assist you find the right policy.

It will certainly help your family members repay financial obligation, obtain earnings, and reach major economic objectives (like university tuition) in case you're not below. A life insurance policy plan is fundamental to planning these financial considerations. In exchange for paying a regular monthly premium, you can obtain a set amount of insurance protection.

Some Known Factual Statements About The Wallace Insurance Agency

Life insurance policy is ideal for almost everybody, even if you're young. Individuals in their 20s, 30s and even 40s frequently ignore life insurance policy.

The more time it takes to open up a plan, the even more danger you face that an unanticipated occasion can leave your family members without protection or financial assistance. Depending upon where you're at in your life, it is very important to recognize precisely which sort of life insurance is best for you or if you require any kind of whatsoever.

More About The Wallace Insurance Agency

A homeowner with 25 years continuing to be on their home mortgage might take out a policy of the same size. Or let's say you're 30 and plan to have kids quickly. In that case, enrolling in a 30-year plan would certainly secure your premiums for the following thirty years.